In the Web2 world, I am a fintech nerd so it was only fitting that my ‘falling into the rabbit hole’ moment for Web3 was via decentralised finance (DeFi). We’ve seen enormous DeFi projects take off in the decentralised exchange and lending categories. But my interest recently has been in that tiny sliver to the right of the graph that’s barely visible – the options category, which currently sits at only ~$300m total value locked (as at 27 June 2022). Total value locked (TVL) represents the value of crypto assets deposited in a protocol including staking, lending and liquidity pools. It’s typically a proxy for interest in a particular crypto sector.

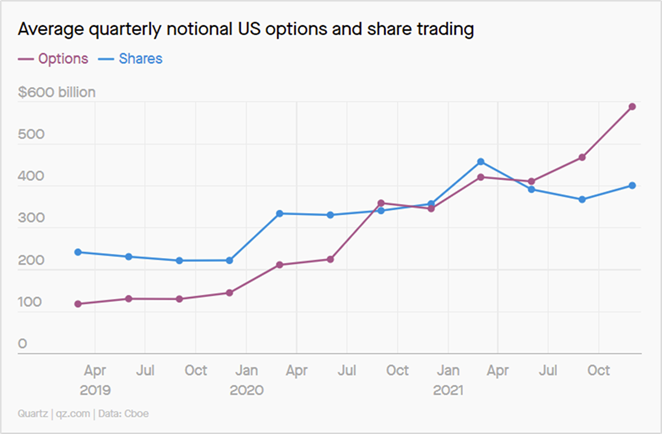

Why this interest in options? In traditional finance, options are a massive market, with the average daily notional value traded rising to more than $450B in the US in 2021. Options are a type of derivative that gives the buyer the right but not the obligation to buy or sell an underlying asset at a fixed price on or before the contract expires. They are typically used to hedge risk or speculate in a more flexible way.

DeFi has the potential to take this highly composable financial instrument and replace intermediaries typically involved in options market making with written, programmable logic. As the barriers to options market making are lowered, it is likely that options product innovation in DeFi will go beyond what is possible in TradFi. In theory, it can become a powerful risk management tool accessible to any retail trader. In practice, this complex instrument needs to be well understood by retail traders to be properly implemented and there remains a long education journey on that front.

There are still enormous technical challenges to overcome before DeFi options exchanges can take a bite of the 80-90% market share held by the centralised exchange Deribit. This includes:

- Low liquidity (need to overcome the chicken and egg problem where traders aren’t attracted to DeFi options exchanges yet due to low liquidity and limited trading pairs)

- High gas fees (can be solved by choosing the right L1 chain or ETH L2)

- Security and stability of the platform (again, choosing the right chain becomes important)

- Low capital efficiency (need to move away from full collateralisation requirements)

However, it’s incredibly exciting to see the depth and quality of the teams that are building in this space: Zeta Markets, Opyn, Hegic, Premia, Dopex, Lyra to name a few.

If you’re building in this space, would love to chat! Reach out at lucy@squarepegcap.com

.jpg)

.jpg)